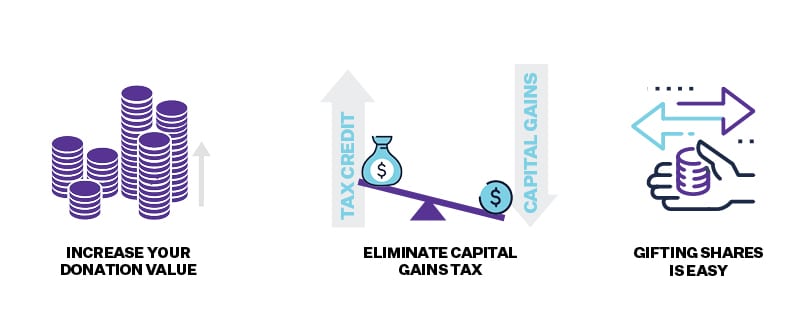

Donate stocks, bonds, or mutual fund shares instead of cash and you’ll extend your tax savings even further. When you donate these types of securities to Surrey Hospitals Foundation, you benefit in two ways:

- You receive an immediate donation receipt for the fair market value of the security, and

- You benefit from the complete elimination of capital gains tax on those shares

Ready to donate shares now? Download the Security Transfers Form here.